If you're like most senior residents, you know your chosen specialty inside out — but very little about negotiating employment contracts. That's unfortunate, because the decisions you make during your first job search can have far-reaching consequences that impact your future prospects, retirement, and so much more.

In our roles as Senior Medical Recruiter and Benefits Director at Vituity, we’ve spoken with thousands of physician job seekers over the years. We’ve seen the good, the bad, and the ugly when it comes to employment situations.

Even in today's excellent job market that favors physicians, aggressive recruiting tactics, attractive sign-on bonuses, and hefty student loan obligations may tempt you to accept an offer from the highest bidder. Failing to consider more than just starting salary, however, can set you up for problems later.

That's where we can help. Scott Bradford is a Senior Medical Recruiter at Vituity with 14 years of experience in the industry. Chris Renner is Benefits Director for Vituity, overseeing health plan, retirement, and other benefits for 7,000 employees and partners. In this piece, we’ll share our best practices that consider all angles of a job offer in the medical field before accepting:

- How to evaluate potential employers

- What to look for in job offer, including compensation and benefits

- How to close the deal

It Pays to Be Nosy

A close friend of ours (let's call him Jeff) worked as an emergency physician for a corporate management group. Several years ago, the group lost its contract at the hospital where Jeff worked.

Unbeknownst to Jeff, the group had a non-compete clause in its contract with the hospital. This meant that the hospital would have to pay the group a hefty fee in order to retain any of the group's physicians.

The hospital wanted to keep Jeff, but it wouldn’t pay the contract penalty. So Jeff was left holding the bag.

This happened in 2009 when the housing market was tanking. Jeff couldn’t sell his house if he had wanted to, and he didn’t want to uproot his family to find a job in a different market anyway. So he paid the $30,000 fee himself in order to stay at the hospital.

It’s a scary story but more commonplace than a lot of physicians realize. To help you avoid these kinds of surprises, here are some “hidden monsters” to be aware of as you evaluate potential employers.

1. Non-compete agreements

These often take physicians by surprise, because the clauses are buried in the contract between the hospital and the management group. In addition, some employment contracts bar physicians from practicing within a certain geographic area for one to two years if they leave the group. This can make it extremely tough to escape a bad work situation without uprooting your life and family. Job seekers should ask about non-competes and either avoid them or negotiate the narrowest scope possible.

2. Lack of tail coverage

These days, most practices carry long-tail liability policies that cover both current and former physicians. However, it's worth asking about this when evaluating a benefits package. This is especially true if you’re considering a smaller independent practice or locum tenens employment.

3. Financial solvency

Job seekers should understand the health of the group’s finances. The organization should be fully transparent about its financial health, where the money goes, and how it's preparing for a rainy day.

4. Contract stability

Hospital contracts can change hands between physician management companies. The last thing you want is for your hospital site to sever ties with your physician group just as you’re getting started. Make sure you’re entering into a situation where the hospital and physician group have a strong, stable relationship.

5. Poor support for disciplinary actions and malpractice claims

Whether it’s a poor clinical outcome or a disgruntled patient complaining to the medical board, investigations happen and can be a black mark on your permanent record. Some physician groups choose to settle lower-cost claims rather than defend them. A malpractice claim carries a stigma that will stay with you throughout your career, so it’s important to find out how aggressive a prospective employer is when it comes to defending its physicians.

6. Lack of vision for future

The healthcare industry continues to evolve at a dizzying pace. Does the organization have a plan to stay competitive in an increasingly difficult market?

Retirement and Benefits

Most residents aren’t thinking about retirement when they begin their careers. But the employment model you choose can have a significant impact on your age and security in retirement.

Many millennial job seekers are drawn to physician employment, lured by the idea of a balanced, predictable schedule and a steady paycheck. However, the biggest mistake senior residents make is not considering the after-tax ramifications of their employment decisions.

When evaluating an employment opportunity, you must consider the full benefits package, not simply the salary. Being an owner in a physician partnership, for example, can provide significant tax advantages that corporate employment doesn’t offer.

For example, while corporations can cover some expenses like healthcare and continuing education, they do not allow you to take any tax deductions outside of a 401(k).

By contrast, partnerships permit you to deduct expenses such as CMEs, health plan premiums, home office expenses, and business-related cell phone, travel, and internet costs.

Also, if you would like to incorporate to take further advantage of vehicle depreciation or pass-through income, you can do so within a partnership.

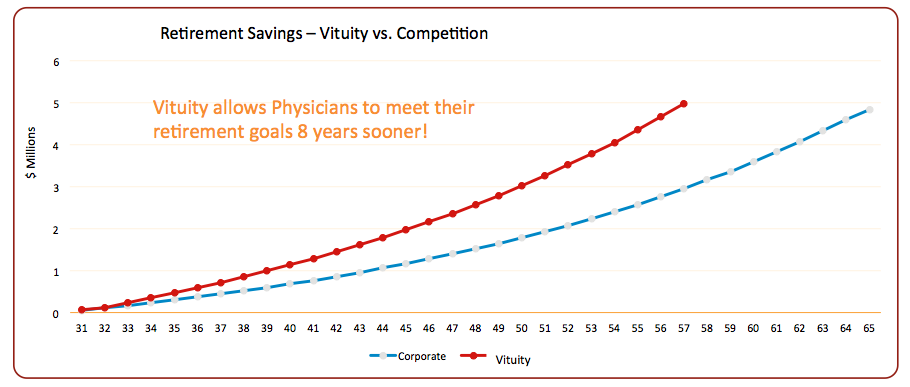

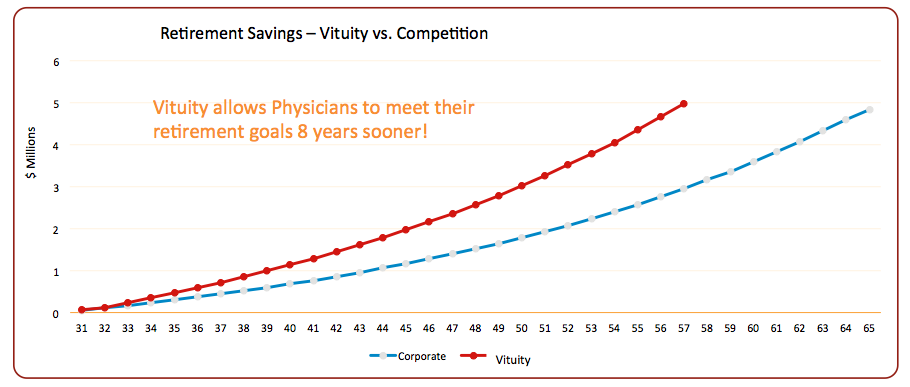

At Vituity, physician partners can shelter $86,000 a year between a 401(k) and a Defined Benefit Plan, while most corporate groups only let you set aside, between $18,000 and $36,000 per year in a 401(k) (including matching funds).

In relation to Vituity’s primary competitors, you will need to work eight years longer to reach your retirement goals.

Working clinical shifts can be mentally and physically exhausting, and the years and mileage can take their toll. Wouldn’t you rather have the option of retiring early in your 50s rather than at 65?

On top of the tax advantages, partnerships give physicians a voice in how their practice operates. Partners determine how much physicians should be paid on an hourly basis and how to invest or divide surplus funds. Vituity's local practices are supported by our national organization with financial planning, educational opportunities, and a wealth of other resources.

Close the Deal on Your Future

When conducting your first job search, do your homework on potential employers. Prepare a list of questions to ask during each interview. Take advantage of financial planning resources the prospective organization offers to help you understand how the company’s benefits compare to the competition.

Be objective about the salary and bonuses and consider the tax implications of the employment arrangement. Think about what will be the best choice for you in a decade when you are preparing to send your kids to college. Farther down the road, will you be able to scale back your workload or retire when you’d like?

Physician contracts are not “take it or leave it” propositions. There is room to negotiate on things like salary, loan forgiveness, and non-compete clauses. Remember to get everything in writing, because handshake deals are not legally binding. If you don’t like a contract provision, and there is no reasonable way to change the terms, then that is a strong signal to walk away.

So there you have them: our best tips for physician job seekers. Remember, the market is in your favor right now. Take your time, do your homework, and don’t be afraid to stand up for your interests. Thanks for reading, and good luck with your search!

Want to build a rewarding, long-term career with Vituity?

Visit our Careers page to learn how.

Originally published August 14, 2018. Last updated June. 23, 2020.